When laying out the roadmap for Capital, we decided on the following core goals. Operational efficiency, Flexibility, Ease of change, As much or as little control as desired, Scalability and Cross jurisdiction (internationalised).

Features

Don’t be constrained by the default product offerings. The unique design of Capital allows you to create any type of product you can think of, even providing your own rules and operational logic through the high-performance system extension facility. Whatever you can think of, you can create.

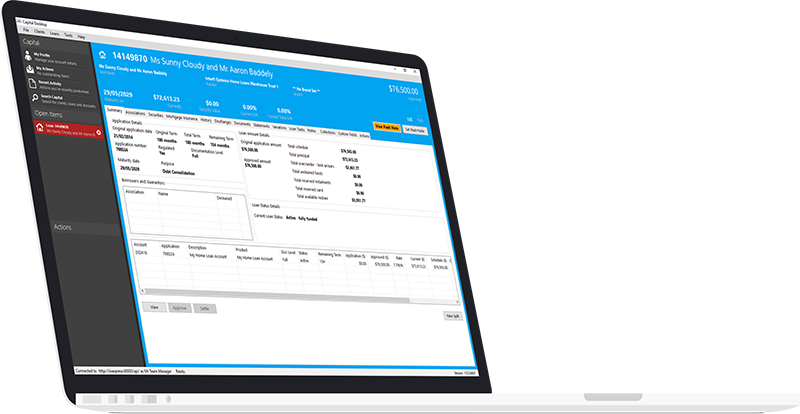

You can define an unlimited number of types of associations between parties and instruments in Capital, allowing you to capture whatever level of detail around the legal and operational relationships you need.

You can run as many rate components against an account as you want, allowing you to choose to apply them to the delivery rate, or simply track them as an index, with full rate change history per component and per account.

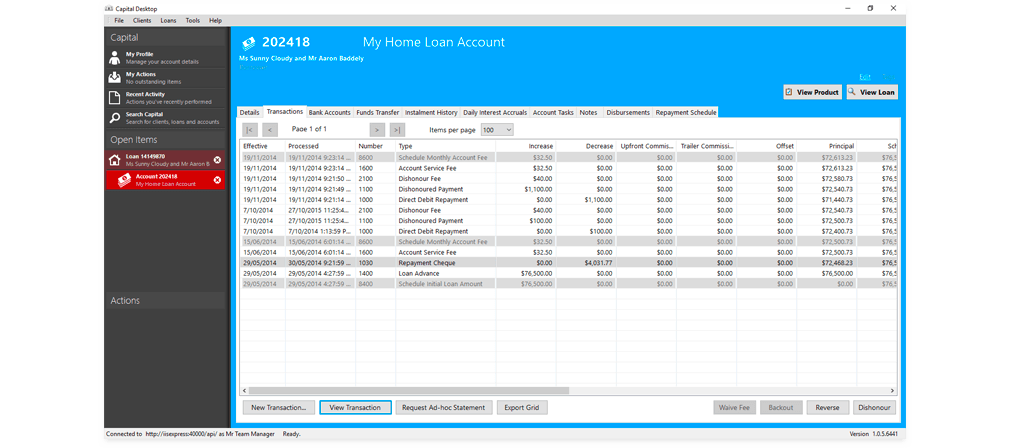

Fees can be applied automatically at predefined times, or on an ad-hoc basis. Fees work in a similar way to rates, allowing you to facilitate future dated changes, as well as tracking the full fee history over time for an account.

Capital can track multiple balances with configurable transaction effects per balance, allowing you to have a parallel “perfectly maintained” balance that you can use to better establish the position of an instrument against the actual balance. Balances and their related transaction types are fully customisable on the fly.

Parties eligible to receive commissions get their own accounts where every commission movement is tracked over the reporting period, allowing for upfront, trail and clawbacks, and producing a net amount payable or owed at the end.

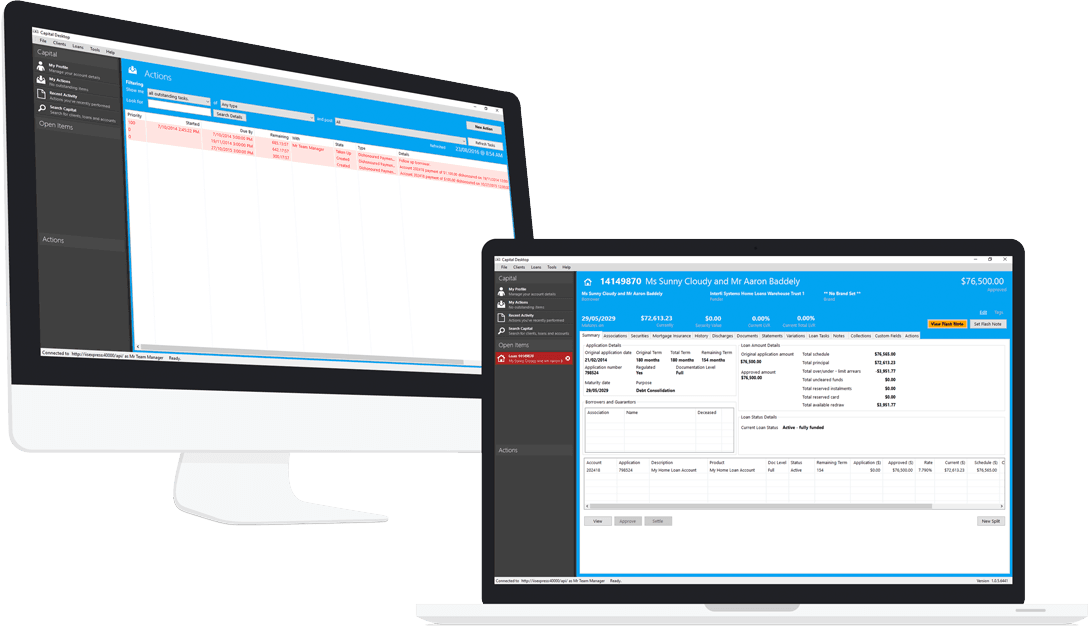

Events that occur within Capital automatically generate to-do items to be followed up by operators. These TDIs track their full history, and have KPIs assignable to them. TDIs can be re-assigned within a work pool hierarchy configurable by you. You can create your own ad-hoc TDIs as well.

Your customers can access their accounts online through a responsive web portal, promoting self-service while you maintain strict controls around what they can and cannot do. Full interaction history is recorded for the lifetime of the profile, and you can suspend or cancel access instantly with the click of a button.

Third-party intermediaries can also have their own separate internet portal where they can stand in as the first line of customer service, having access to a similar level of information as your internal operators. Again, each interaction is recorded, and you have full operational control over what each profile is able to do.

Engage and implement off-shore back office with little to no impact. Give operators as much or as little control as you want. Manage staff interactions with the TDI system with full auditability and history.

The full feature set of the Capital platform is too large to cover in a simple website. Please get in touch with us to arrange an information pack and start a conversation with our client services team.